What Is Azuro?

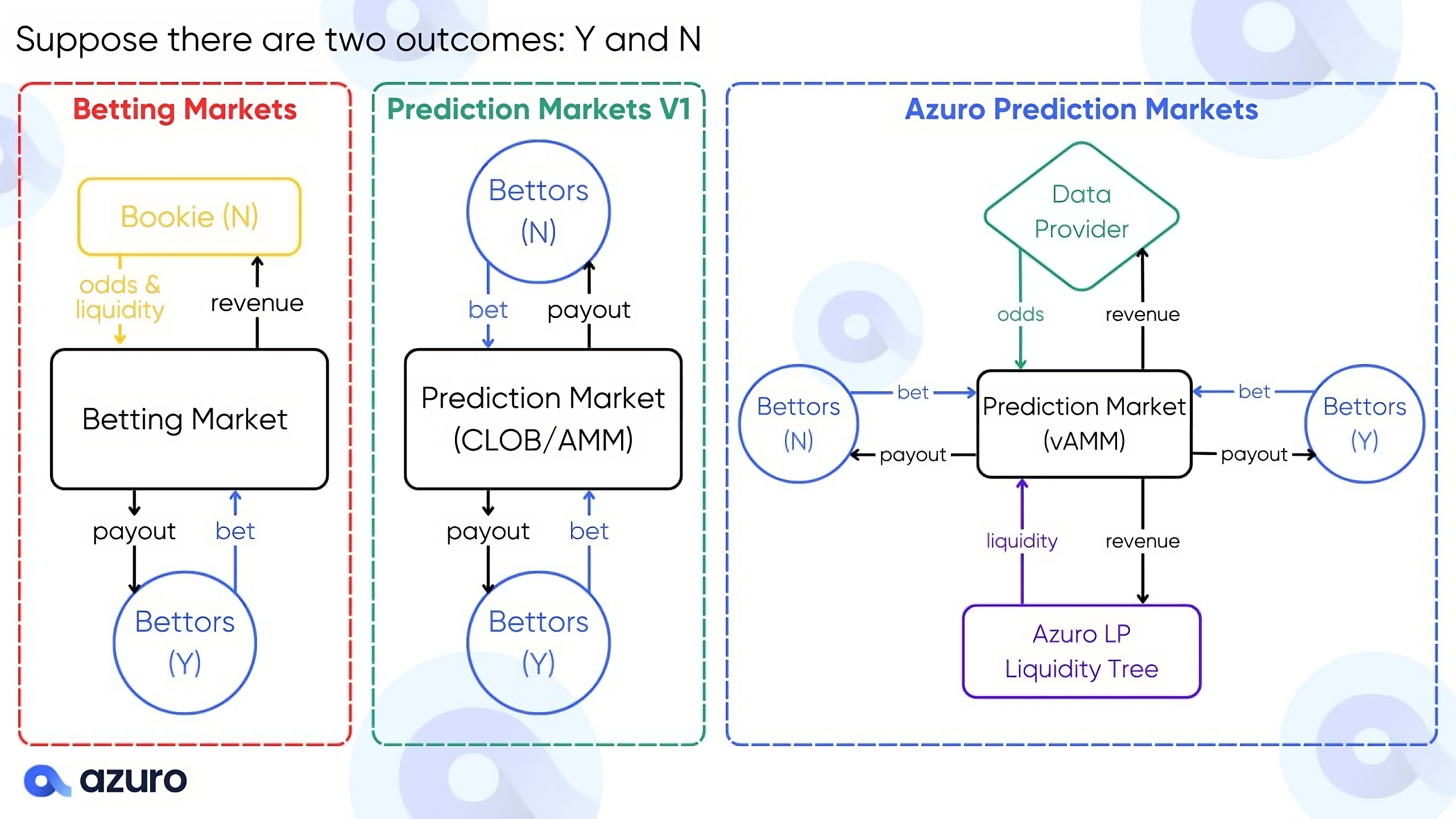

Azuro is a decentralized protocol for prediction markets. Unlike most of its industry peers, Azuro does not use the orderbook model as the mechanism underpinning its prediction markets, opting for a dynamic AMM-based approach under a singular concentrated liquidity pool model.

Utilizing vAMMs and our novel LiquidityTree fund accounting system, all prediction markets on Azuro inherit the full might of Azuro’s singleton LPs. This allows each market to ‘book’ liquidity and scale (aka service bets) in an unconstrained manner, up to the entire capacity of the pool.

Anyone can be an LP on Azuro: simply choose a preferred pool and deposit your funds. When LP’ing on Azuro, you’re automatically exposed to all prediction markets that are seeded by the pool you’re LP’ing in, allowing you to passively earn stablecoin yield off the betting activity from all of these markets.

In addition, Azuro apps compete with each other to offer bettors with the best interface and user experience. Anyone in the world can spin-up a front-end, connect to the protocol, and facilitate bets — there is no designated canonical app that could be Azuro’s single point-of-failure.

The Azuro project is made up of three separate yet interconnected branches:

-

Azuro Protocol: A suite of smart contracts which can be used permissionlessly for the creation of prediction applications & products on EVM-compatible blockchains. Bettors interact with the protocol to place permissionless bets, apps use it to facilitate bets, while viewer interfaces may use it to present rich actionable insights and event probabilities.

-

AzuroSDK: Web components that make it quick & easy to build applications on Azuro Protocol. Betting interfaces are only one of the many instances of apps on Azuro.

-

AzuroDAO: A decentralized system to govern the Azuro Protocol at steady-state. AZUR will serve as the Schelling point token, operating under the [redacted] mechanism.