A Primer on Prediction Markets

Prediction markets are fundamentally a simple premise: it is a bidirectional trading market for bettors to express a view over an outcome.

The concept borrows from Friedrich Hayes’ assertion, that the price system in a free market accurately expresses the aggregate views of market participants over the traded asset. In the case of prediction markets, assuming a free market environment, the price per share will reflect the aggregate view of market participants over the likelihood of the traded outcome.

Hence, prediction markets form reliable unbiased indicators over the probabilities of an outcome, backed by the skin-in-the-game of profit-motivated entities participating in the market.

Isn’t it just glorified betting?

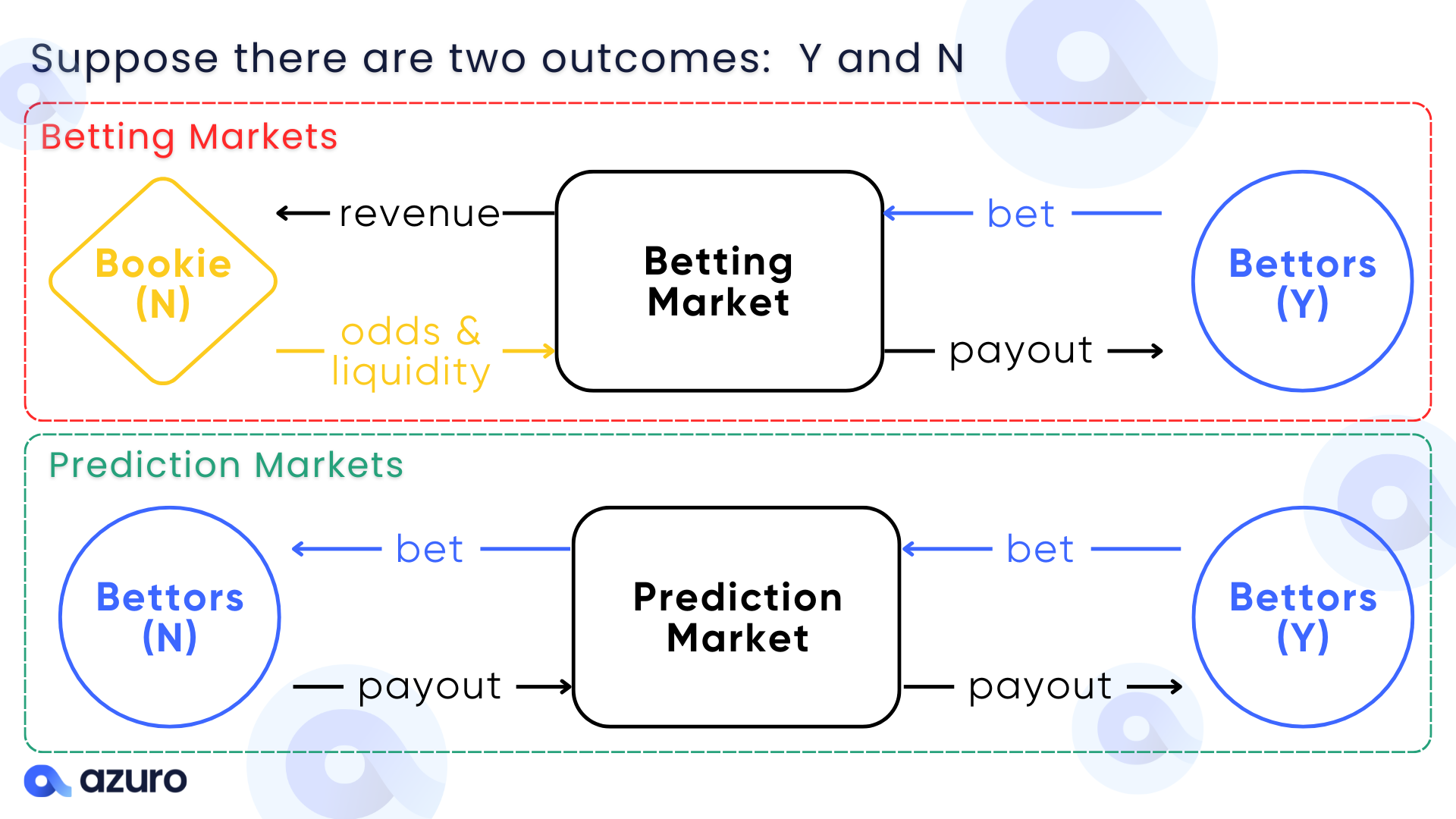

The main difference between prediction markets and betting platforms lie in the manner of how odds (or probabilities) are derived for an outcome:

-

In prediction markets, the free market determines the odds of an event, calculated as a byproduct of betting flows on either side of the bidirectional trade.

-

In betting platforms, the operator or bookie forms an opinionated understanding on an event and sets the odds for bettors to bet on (with a margin of error). Bettors are welcome to bet against this opinion, and if they’re proven correct, then the operator will lose money. The free market has little influence over a bookie’s offered odds — “feedback” is in form of profits (if the bookie’s opinion is in line with the free market) or losses (if “wrong” from actual truth).

Henceforth, prediction markets are treated as a more credible source denoting the ‘true’ odds of an outcome happening. Odds obtained from betting platforms merely represent the opinion of the operator or bookie (although they are incentivized to make them as competitive as possible in order to attract betting volume) — it doesn’t reflect the true probability of an outcome.

Put simply, prediction market odds reflect “free market probabilities” as a byproduct of open betting flows, while betting platforms impose “opinionated probabilities” for bettors to bet on.