Tokenomics

| Property | Details |

|---|---|

| Ticker | AZUR |

| Token Standard | ERC-20 |

| Contract Address | 0x9E6be44cC1236eEf7e1f197418592D363BedCd5A |

| Total Supply | 1 billion |

| Initial Circulating Supply | 152 million |

| DEX | Uniswap V3 |

| DEX Pair | AZUR/ETH |

Distribution

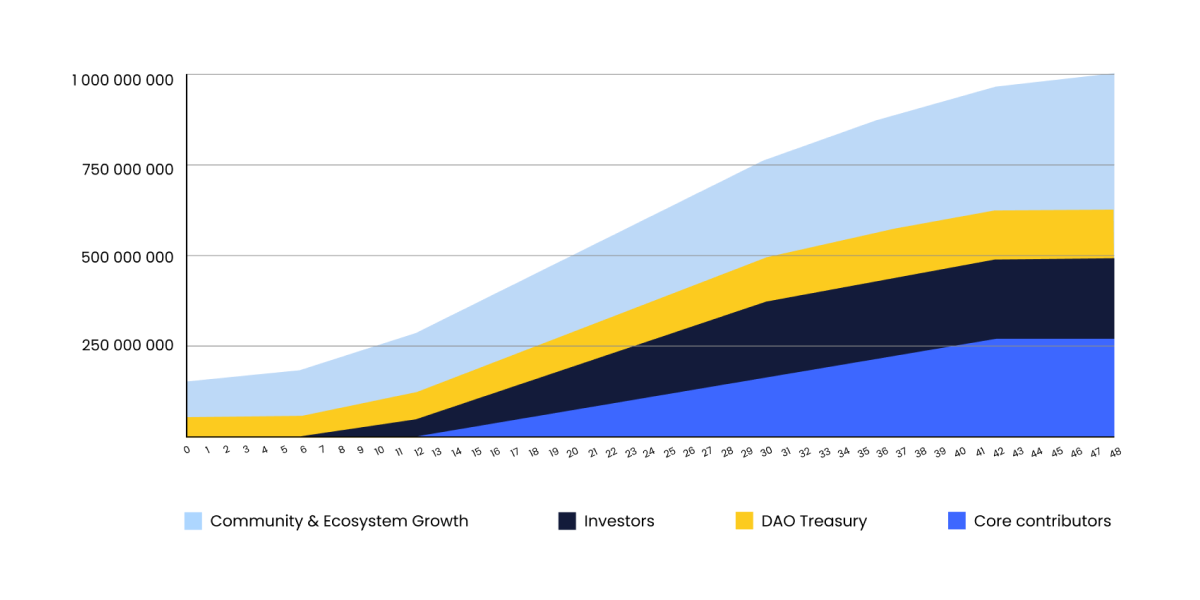

Vesting Schedule

Ecosystem & Community Incentives

37.5% of AZUR is allocated to developing the Azuro ecosystem.

92M AZUR (9.2% of the total supply) is unlocked at the TGE. The rest of the allocation includes the 3% Azuro Score airdrop vesting linearly over 6 months, while 25.3% has a 6-month lockup, after which it unlocks linearly over next 42 months. It will be used for the upcoming Azuro Waves incentive program, DEX liquidity provision incentives, as well as an Ecosystem fund, infrastructure initiatives, and more.

DAO Treasury

60M (6% of the total supply) of AZUR is available at TGE and will be used to support AZUR liquidity both on- and off-chain.

The remaining 75M AZUR (7.5% of total supply) are locked for 6 months followed by 30 month linear vesting. It will be used for initiatives that help advance an open predictions & betting industry that is portable, composable, more fair and more fun, onchain.

Investors

The investor allocation represents tokens obtained by value-add investors backing Azuro protocol’s development. Investors are locked for 6 to 9 months, followed by 24 to 30 month linear block-by-block vesting.

Core Contributors

This portion of the AZUR allocation represents the distribution to the core development team, advisors and partners who have worked on the protocol. All core contributors are locked for 1 year, followed by 30 months linear, block-by-block vesting.