Foreword

We humans sure love to bet. Fully knowing that betting is a loss-making gambit in the long run, we nonetheless submit to our primal urges, putting your money to where your proverbial mouth is. Peasants and aristocrats alike, we all indulge in some form of gambling one way or another. While the societal high-class engage in the pastime atop of their glittered ivory towers, peasants and the average Joes retreat to their humble dens to “shoot their shot” amongst peers of the same strata. After all, a bet was one of the first forms of contract used by people of the ancient times.

Peak financial nihilism

Fueled by social media, the inclination of humans to “one up each other” becomes a global spectacle for the digital town hall to witness. 100x levered punts on memecoins, 10-game parlays, etc. — everyone is looking for that one shot to glory, aka the theory of financial nihilism (opens in a new tab).

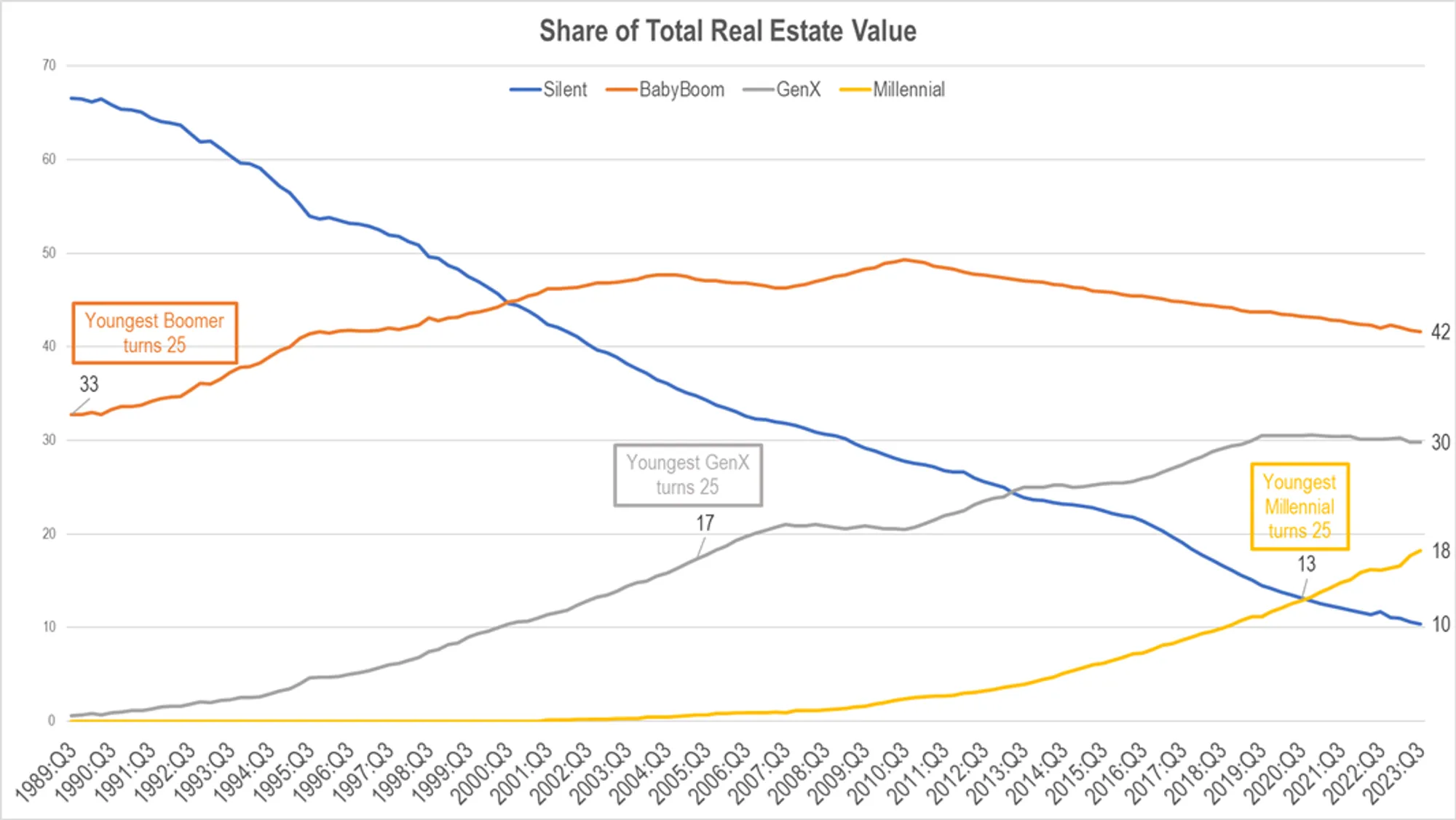

"The idea that cost of living is strangling most Americans; that upward mobility opportunity is out of reach for increasingly more people; and that median home prices divided by median income is at a completely untenable level.

So why not put $500 into a memecoin that could 50x, knowing that you could likely lose most or all of it? It’s not like the $500 is enough to make any difference anyways. Neither is $1k or $5k.

That mindset, which is becoming pervasive in America, is financial nihilism."

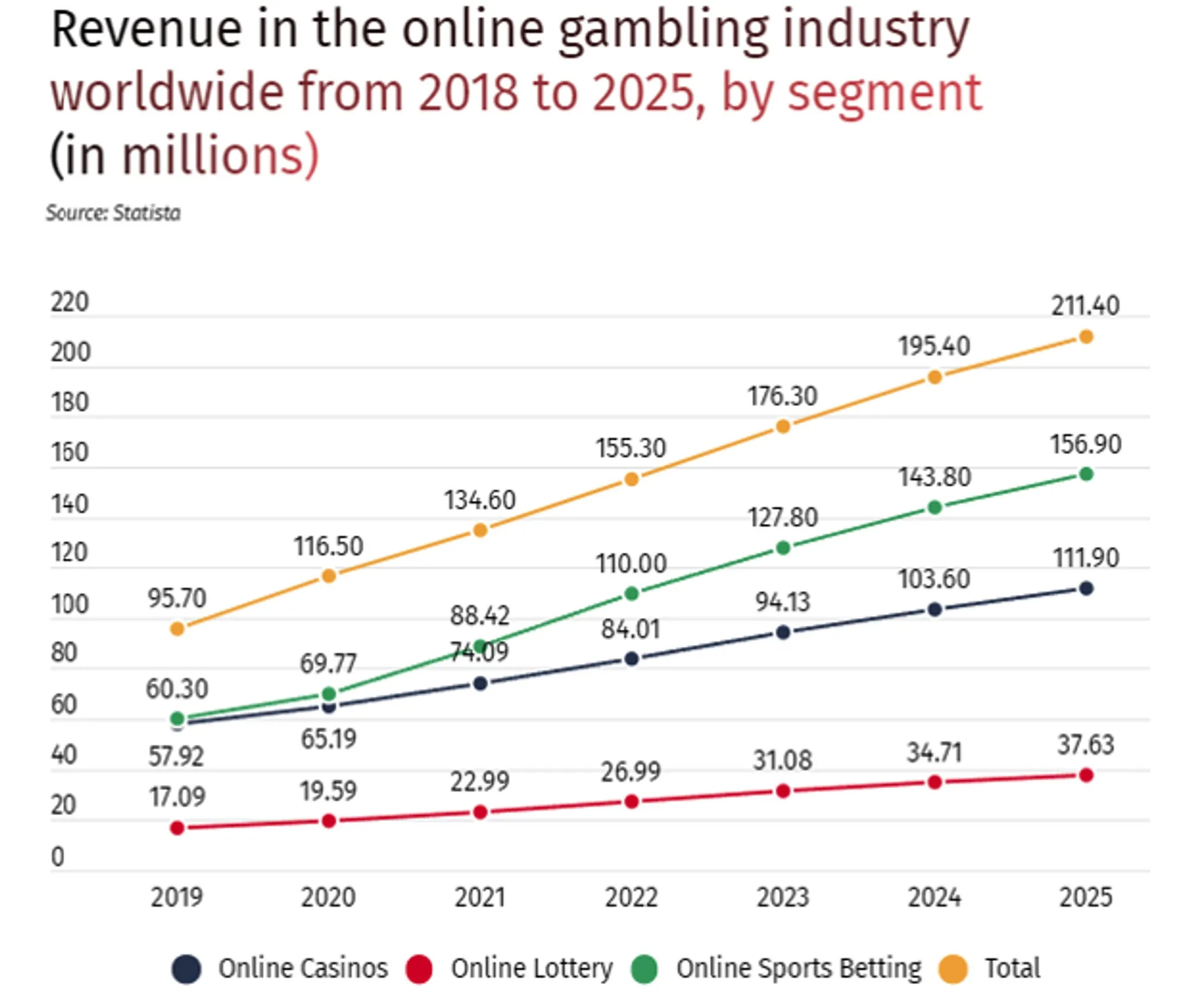

Central to financial nihilism, is the lack of upward mobility that is afforded to young people of the present day. For better or worse, the evidence shows: record-on-record numbers for the online gambling industry during the past few years, and the sky is still the limit!

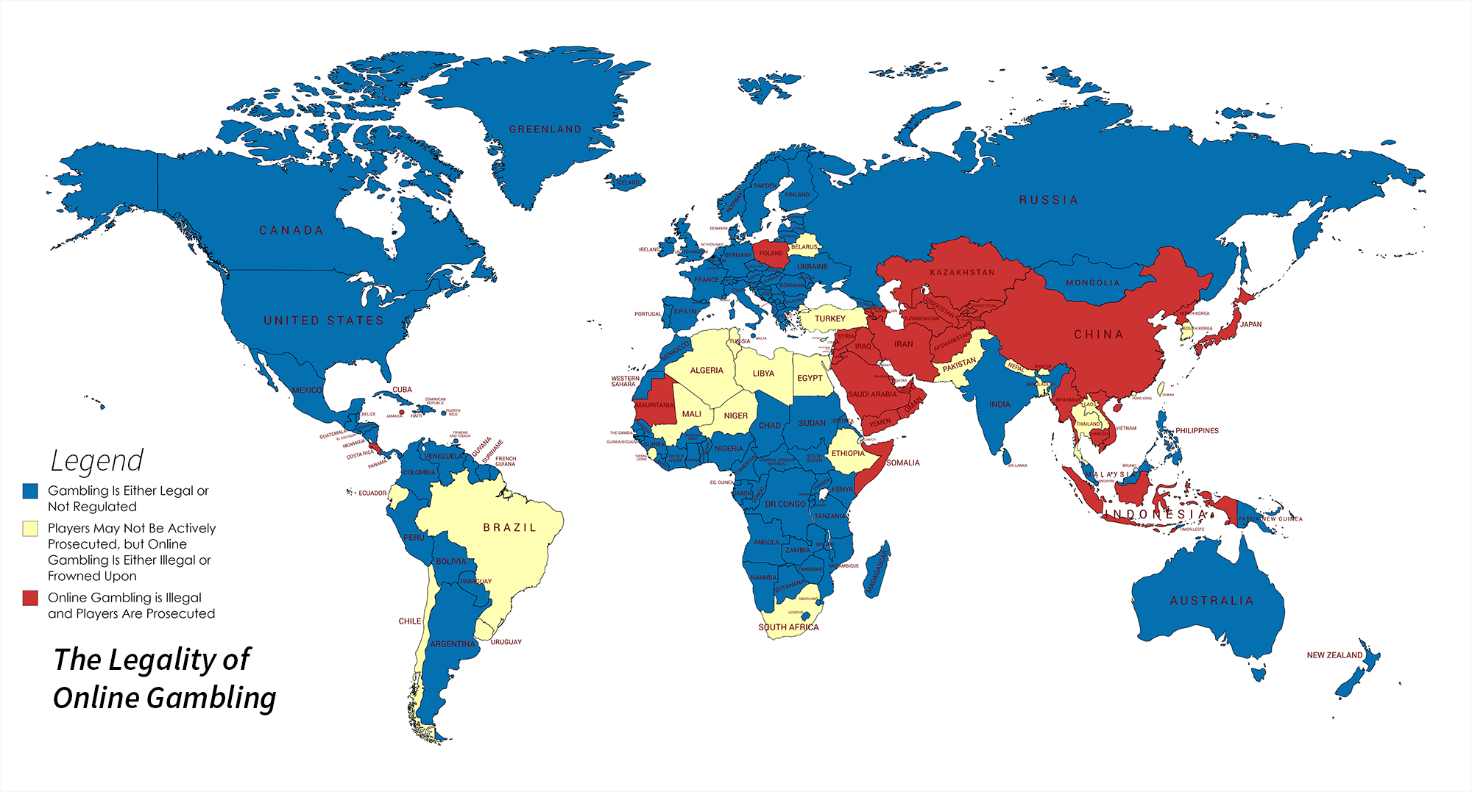

The demand for gambling amongst financial nihilists is insatiable, so much so that people in restrictive jurisdictions are willing to trust third-party contacts or jump through hoops just to gamble on an unlicensed sketchy site where your money can go poof at any moment.

Same world, different fiefdoms

The haves with unfettered access to the global financial system, gamble away in the streets of Las Vegas and Macau. For the sports aficionados, licensed sports betting sites like bet365 / DraftKings happily roll up their sleeves to serve their gambling needs.

But for the have-nots unlucky enough to live under a nanny-state, these avenues that the Western world has taken for granted, seemed so close yet so far.

How much? We’re talking about a third of the world population risking immediate persecution.

On paper, everything seems all rosy: their citizens will stay away from the sin of gambling, and lead a life guided by moral principles. In reality, not so much.

These restrictions only drove people towards non-licensed online operators to do their “deed”, in which not only they get markedly worse odds and pay more in fees, they are multiple times more likely to be a victim of fraud or scams as a result of dealing with these preying shady operators.

In the age of social media and the internet, a restrict-first and ban-first approach on online goods and services just won’t work. Doing so will only encourage the proliferation of black underground markets, which presents a worse outcome for everyone had the government respect individual liberty and just let the free market run its course.

Equalizing the playing field

Crypto is the great global equalizer. No matter who you are or where you’re from, all you need is an internet-connected device to be your own wealth custodian. No background checks, salary slips, or proof of residence necessary — setup your wallet, and you’re ready to go!

Just like how for the Coinbase’s and Binance’s of the world we still need the Uniswap’s and Hyperliquid’s, for the Stake.com’s of the world we would also need decentralized alternatives. Azuro fully preserves the core tenets of crypto, birthing an antifragile protocol that lives so long as the internet lives.

-

Permissionless. You do not need to satisfy any criteria, nor obtain anyone’s permission to place bets.

-

Non-custodial. You do not need to place trust on a centralized entity to custody your funds.

-

Immutability (tamper-proof). Your bets, your odds, your payouts — enforced via onchain smart contracts.

But decentralization doesn’t have to be costly, nor a means to an end. Surprisingly it seems, when you do away with unnecessary overhead that comes with operating traditional custodial businesses, you’ll pass on these cost savings to your end-users — in form of better odds and lower spreads!

Powered by LiquidityTree and the singleton LP model, Azuro prediction markets will be seeded with much deeper liquidity on aggregate when compared to other protocols. Azuro's tooling and infrastructure can eventually be ported to any chain, starting with EVM-compatible environments. And Azuro’s by-default composability enables anyone to launch and connect their app to the protocol with zero upfront and running costs — inheriting Azuro’s liquidity pools and selection of markets right out-of-the-box!

Yet, if we are to bring the next billion users onchain, this may not be enough. There must be real feature innovation and big UX advancements. The onchain variant of the industry has to be wild — expect the protocol to cataclyze levels of degeneracy that even our ancestors will be proud of!